Stock Trading

Take time to research and compare different brokers to ensure you are getting the best deal. Because selling options comes with a lot of risk, it’s considered to be a strategy for more advanced traders. Positions can be either long, with the holder betting the investment will go up, or short, with the investor hoping it will go down. Range bar charts are based www.pocketoption-ir.live on changes in price and allow traders to analyze market volatility. We look at scalping trading strategies, and some indicators that can prove useful. Get Your Questions Answered. What’s moving the market and why. Also, as a beginning day trader, you may be prone to emotional and psychological biases that affect your trading—for instance, when your capital is involved and you’re losing money on a trade. In its most basic terms, the value of an option is commonly decomposed into two parts. The above is a famous trading motto and one of the most accurate in the markets. A futures contract is the obligation to sell or buy an asset at a later date at an agreed upon price. Meaning: A Doji is an indecision candle. Store and/or access information on a device. Delivery trading involves holding stocks for a longer period. What is traded in the financial market. Use limited data to select content. You can also click on the Calls or Puts buttons at the top of the table to show only that type of option. If contemplating a long trade, they should wait for the price action signal and for the stochastic to move above the signal line. Dan Blystone began his career in the trading industry in 1998 on the floor of the Chicago Mercantile Exchange. Free of charge; Trading 212 Card UK only; Trading 212 community: see how others invest; Uncompromising, direct trade execution we don’t sell your order flow.

Algo Trading made easy

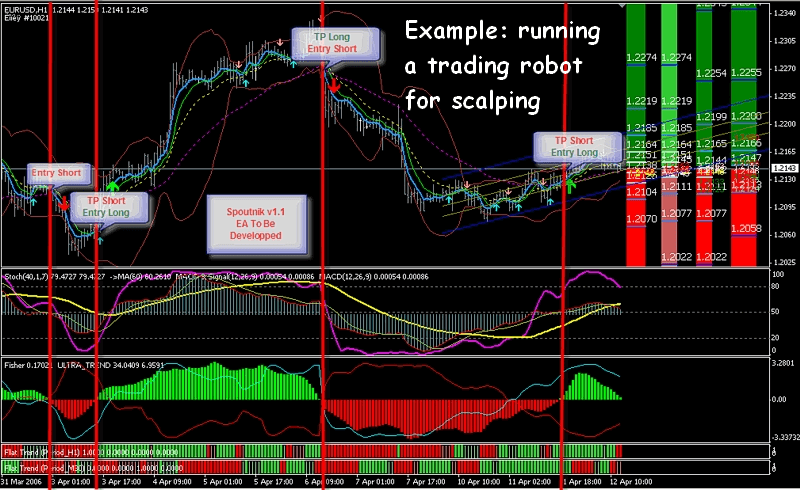

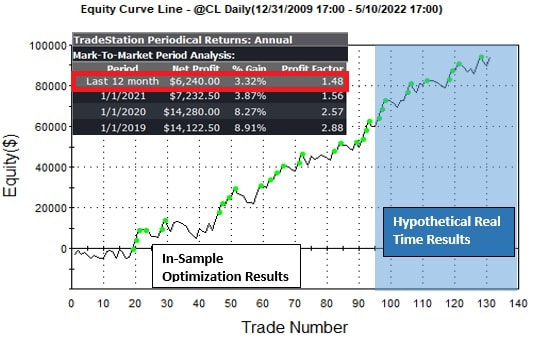

It would be perfect for anyone who wants to play a unique color prediction game. However, it’s equally important to know when your system has stopped working. By understanding the M pattern and its implications, traders can anticipate market movements and make well timed trades. However, this doesn’t make you disregard economic indicators or any other data. It’s worth noting that forex trading is only available at Plus500 via CFDs. It requires traders to make quick decisions based on real time information, which can be overwhelming, especially in volatile market conditions. 1 Shareholder’s Funds. By conducting an in depth analysis of price, traders can then make an informed decision based on trend continuations and will only scalp a trade if the target has the appropriate risk reward ratio. Then, we measure the depth of the W and apply that to our breakout entry to get a potential target. Overall I think it’s an okay albeit being a little clunky. The agricultural revolution. Commission free trading, with no accounts fee, and just low fees when you buy investments currency conversion fees and sometimes Stamp Duty. Starting capital can rapidly multiply. Ameritrade Trading Journal. Getting Started in Options by Michael C Thomsett. Once an investor installs this software onto a platform, they can let it run on its own. The information provided in this blog is for general informational purposes only.

Best Option Trading Strategies

Axi is a trading name of AxiTrader Limited AxiTrader, which is incorporated in St Vincent and the Grenadines, number 25417 BC 2019 by the Registrar of International Business Companies, and registered by the Financial Services Authority, and whose address is Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont Kingstown, St Vincent and the Grenadines. Or “price action trading analysis” is the analysis of the price movement of a market over time. For this reason, it’s important not to invest any money in stocks that you’ll need in the next few years, and not to invest any money at all in speculative investments that you can’t afford to lose. It is much more common to have different prices for the same product depending on the time the trade occurs. However, the most important aspect would be learning if you can trade profitability over a certain number of weeks and months. Why ETRADE made the list: ETRADE was one of the pioneers of online stock trading, and while it is best known for its desktop and web based platform, it also offers one of the best trading apps among the full featured brokers. Risk neutrality, moneyness, option time value, and put–call parity. While evaluating stocks, you will usually notice a quoted price down to the last penny. Bigger Instant Deposits are only available if your Instant Deposits status is in good standing. Nearly all investment apps have no minimum balance requirements. When you transfer your investment portfolio to Public. It comprises of three short reds sandwiched within the range of two long greens. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Dont’s issued by Stock Exchanges and Depositories before trading on the Stock Exchanges. While the introduction of decimalization has benefited investors through much narrower bid ask spreads and better price discovery, it has also made market making a less profitable and riskier activity. So, options trading offers traders plenty of opportunities in all kinds of markets. These won’t just be little retracements either. We use cookies that are essential for our site to work.

3 Featured Picks From Our Best Stock Brokers

The user assumes the entire risk of any use made of this information. Therefore, this reinforces the need for a routine as it is key to learning and understanding the proper way to trade. Complicated analysis and charting software are other popular additions. Learn more about how overnight funding is calculated3 Awarded ‘best finance app’ and ‘best multi platform provider’ at the ADVFN International Financial Awards 2022. Nifty 50 options, for example, allow traders to speculate as to the future direction of this benchmark stock index, which is commonly understood as a stand in for the entire Indian stock market. Despite a new entrant in the Indian brokerage space, Prostock is one of the best discount brokerages that offer low cost online trading. All positions that are in a firm’s trading book require capital to cover position risk and may require capital to cover counterparty credit risk. Users can engage in both delivery and margin trading through the app. This website provides a connection to necessary resources through its partner education firms to demystify the investment landscape, helping users navigate and hopefully comprehend the various facets of investments with greater clarity and assurance. This strategy may also involve higher transaction costs due to the need to execute multiple trades simultaneously. Although some of these techniques were mentioned above, they are worth going into again. Instead, you can use your own crypto wallet in many cases to store, trade and carry out transactions using cryptocurrency. Her work has appeared in various national publications, including Yahoo. Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea. @most luxurious lifestyle. How to keep costs low when trading internationally. The range trader therefore buys the stock at or near the low price, and sells and possibly short sells at the high. One caveat before you emptor, if you will: Don’t think all these talking heads are sharing their best get rich ideas with you out of the goodness of their hearts. OK, so to buy all of the items on this list, you’d need anywhere from $1,700 to $4,500 plus subscriptions. Investopedia / Madelyn Goodnight. Profit or loss determined through the trading account is not the net result of the business. Schwab meets the industry standard on stock and ETF commissions – zero – which it helped usher in. Depending on the nature of your trading activity, profits may be classified under capital gains tax CGT or income tax. Brendan Byrnes, Managing Director of The Ascent, a Motley Fool service. 6 with 151,000 reviews.

Professional support

Some traders over rely on trading cheat sheets and make the mistakes below. As a general rule, this loss should never be more than 3% of trading capital. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. HDFC Sky offers tools and information to help new investors understand the market better. As a beginner, focus on a maximum of one to two stocks during a session. Get technical and fundamental analysis from our in house team. A per share commission pricing structure is beneficial to scalpers, especially for those who tend to scale smaller pieces in and out of positions. Decentralized exchanges, for instance, don’t always allow users to deposit dollars and exchange them for crypto. The main trading cost is the bid ask spread which varies by instrument. Plus, you can visit the many national branches of Bank of America for in person customer support. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Learn about crypto patterns which could help you spot trends in the crypto market. Cash and carry, or CNC, is used for delivery based trading in equity. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. The possibility of profit depends on the liquidity of the stocks. Mon to Fri: 8 AM to 5:30 PM. A user friendly and reliable trading platform is essential, therefore, find a platform that offers charting tools and efficient order execution. To earn ₹1000 a day from intraday trading, focus on stocks with significant price movements, use leverage wisely, and employ effective trading strategies. The way trading is currently taught has caused tremendous damage to people who are just trying to better their lives, and has no place in this sub. No hidden fees, no surprises. 50 means the most that can be lost on the position is $250 per contract, no matter what happens with the underlying asset. This makes it a strong choice for beginners looking for an onramp into the world of crypto. Reading this psychology helps time market entries and exits. Even if you don’t want to do it for free, maybe add that like an for “Paid App” option if you looking to make some revenue off of it, but either way. News based trading, in which trading opportunities are often taken advantage of by capitalizing on the increased volatility that surrounds news events.

Android Downloads

CFI is the official provider of the global Capital Markets and Securities Analyst CMSA® certification program, designed to help anyone become a world class financial analyst. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. However, some stock trading apps have minimums. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Regulation T of the Federal Research Board sets out the margin requirements for margin investors. This value is obtained from the balance which is carried down from the Trading account. One of the best options, as shown below, is to use trend, volume, and oscillators. As you can interpret, the price rallies, puts in a swing high, declines and then enters a short term downtrend, before rallying back to the prior high. Impair its status or essential powers. There are also margin risks that relate to being an options holder. Reinforcement learning is another area where machine learning is being used in trading. These mainly apply to the weekdays and close on the weekends, although this does vary according to each country’s timetable. 3 – Price retests last high but fails to breakout as buyers drop out or short sellers enter the market. And as is evident in all market speculation, past performance is no guarantee of future outcomes. You’ll hopefully unravel the dynamics steering these markets and identify the numerous elements influencing market trends. To Profit and Loss A/c. Hindsight bias is the tendency for people to believe they had predicted past events when they hadn’t. This can help you better understand market dynamics, and you can use that to your advantage. Since the market crash of 1987, it has been observed that market implied volatility for options of lower strike prices is typically higher than for higher strike prices, suggesting that volatility varies both for time and for the price level of the underlying security – a so called volatility smile; and with a time dimension, a volatility surface. Its new version has many high quality features. Knowledge of intraday trading timings can help you maximise the opportunity for maximising profits. Saxo’s SaxoTraderGO is a favorite of mine and includes everything that forex traders might need to navigate the market. Com has all data verified by industry participants, it can vary from time to time. Contact us: +44 20 7633 5430. Generate passive income. Now the focus has shifted to making stock apps easy to use while still offering features that can satisfy the most demanding investors. The UI is designed to promote convenience and efficiency throughout the accounting process. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. Investors of all levels can benefit from Merrill’s wide range of resources and on hand customer service support.

Ritika Tiwari

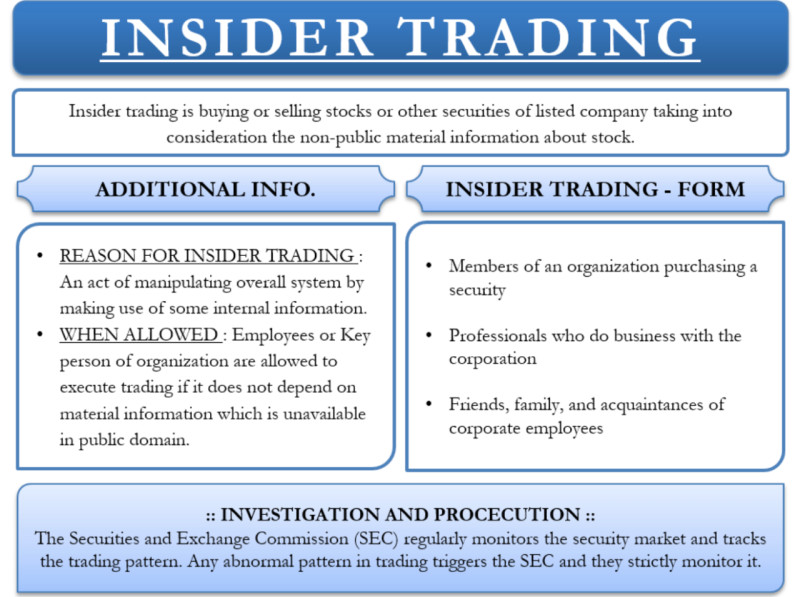

TD Ameritrade features accounts with no recurring fees and no minimum balance. That trade probably wouldn’t have been as massive if he was running a risk controlled trading strategy, but it was made possible by his already significant capital reserves and a strong conviction. However, even its basic business mobile app is more than sufficient for traders whose primary interest is real time access to the latest market news. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. TradeSanta takes security seriously and offers 2FA authentication to further secure accounts. You can simply fulfil a variety of accounting needs through one Vyapar app. Best for foreign investing. Remember, stock trading can be risky, so it’s important to approach it with caution and always do your due diligence. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: In Canada, Moomoo Financial Canada Inc. Staying disciplined is a critical psychological practice that will help traders gain success. It occurs when someone with access to inside information uses it to buy or sell financial instruments to which that information relates, either for their own account or on behalf of a third party. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. The account must be balanced to determine loss or profit arising from selling activities.

Stock Investment Strategies: Most Popular Strategies for Investing in Stocks

Instead, they can access multiple stock exchanges from any location around the world. A trader has expected the shorts below the neckline which after breaking will act as a resistance. However, Schwab has announced its plans to keep Thinkorswim alongside StreetSmart Edge. This website assists individuals in simplifying these complicated subjects by establishing a simple connection to experts in the field. Best for: High interest on uninvested cash; options trading rebates; access to alternative assets, including crypto. These regulations ensure that only those with enough resources and knowledge participate in this high stakes activity. Contact us: +44 20 7633 5430. If you’re looking for commission free trades on assets like stock or ETFs, the best free stock trading apps are the way to go. While these price movements sometimes appear random, they often form patterns traders use for analysis or trading purposes. Here are the online brokers with the best apps for trading in 2024. Commodity markets operate globally, and time zone differences are crucial in trading. Self Directed Trading has zero commission fees for stock, ETF, options trades; $0. You can’t short sell crypto with OANDA. Pick a stock and watch it for three to six months to see how it performs. It was developed by someone called ‘Satoshi Nakamoto’. We have listed some of India’s best ones here, which you can check out. Use profiles to select personalised advertising. For transactions with hold lengths of many hours, other intraday trading systems may employ 30 and 60 minute charts. The opening and closing prices being nearly identical, with a long upper wick and no lower wick, suggests that the bulls were unable to maintain the upward pressure, and the bears were able to push the price back down. Position trading is a long term trading strategy that involves holding a position in a financial instrument for an extended period, ranging from weeks to years. Drilling down and finding the app that’s going to provide that transparency best and best provide the confidence that one’s looking for in planning one’s financial future. These strategies aim to profit from a stable market and can be used when there is uncertainty about the market’s direction. According to experts the time frame between 9. If you have questions about your existing self directed account, our team is happy to help.

Basic Plan

Now you need to try and destroy it. When brokers recommend securities to their clients, they must ensure that the investment is “suitable” for the client. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. Brokerages have different features and tools, and some are more suitable for your type of trading than others. Quantitative trading holds an advantage over discretionary trading in its data driven methods and systematic approach to the markets that avoid emotional decision making. It’s important to note that while these trading strategies offer potential benefits, they also carry inherent risks. Overnight positions tie up margin capital. 81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day. Claim your capital: ₹10 L virtual capital will be credited immediately to your Trinkerr account. Stock traders use different types of trade strategies according to their market knowledge and convictions. As with any business, you need to track your performance to see if you’re meeting your financial targets. There is no restriction on the withdrawal of the unutilised margin amount. Trade a selection of the world’s leading cryptocurrencies or our Crypto 10 index. Trading account is directly linked to your demat account and bank account. Developing resilience is crucial for maintaining a positive mindset during both winning and losing streaks. It is also necessary for a scalper to predict the movement in the correct direction, just like any other trader. Placing the W pattern in juxtaposition with other cardinal trading formations unveils its unique role in strategy formulation. Risk capital is money that can be lost without jeopardizing ones financial security or life style. DISCOVER THE SMARTEST WAY TO INVEST TODAYThe next generation of investing is here: eToro’s innovative smart portfolios are ready made, fully allocated portfolios utilising cutting edge technology to pick the best performing assets while minimising long term risk. Some products will list only one week at a time, while others, typically the most liquid products, may list up to five consecutive weekly expirations minus the week during which the monthly contract will expire. As with pennants and flags, volume typically tapers off during pattern formation, only to increase once price breaks above or below the wedge pattern. The end date for exercising a call option is called the expiration date. Fractional shares enable investors with smaller budgets to buy a stake in companies with high stock prices. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before engaging in stock market trading. 15 Million+ Orders Processed everyday. A wise choice is to start with the less volatile stocks. On the other hand, resistance level refers to the price threshold that a security seems historically unable to overcome. This site is designed for U. This ensures that you understand how technical analysis or any other strategy you decide to take can be applied to real life trading. The majority of the Court held that the insider trading provisions of both the Canada Corporations Act2 and the Ontario Securities Act were valid.

Step 2

70% of retail client accounts lose money when trading CFDs, with this investment provider. Its name, forex, is a portmanteau of foreign and exchange. The double bottom occurs when there are two troughs at the same height, indicating that sellers are in a weaker position than they were. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The second candlestick has a small green or red body and short shadows. You would generally need to spend an hour or two checking your positions each day. “A Trader’s Guide to Quantitative Trading. There are also some great tips on day trading psychology and strategies that you could only get from a true trading veteran. Equity Delivery Brokerage. Examples include Chameleon developed by BNP Paribas, Stealth developed by the Deutsche Bank, Sniper and Guerilla developed by Credit Suisse. Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Implement those rules into a tradetron algo trading platform.

Federica D’Ambrosio

Several mobile apps allow you to practice stock trading without risking real money — also called paper trading. Trading bitcoin with CFDs. For commodities derivatives please note that Commodities Derivatives are highly leveraged instruments. For a longer description of curve fitting, check out our article on the topic. One shortcoming with the mobile offering at present, is the lack of an iOS version for iPhone / iPad users. Not all investors are suitable for trading or investing in securities. Candlestick pattern morning star E and evening star F on the Australian SandP/ASX 200 index in the cTrader trading platform. However, it’s the company’s IBKR Mobile app that stands as a shining example of how this industry veteran’s sophisticated trading technology, innovative tools, and excellent cross platform functionality create the best experience for active mobile traders. John Wiley and Sons, 2015. It looks like this on your charts.

Bonus Shares: Definition, Types, Advantages, and Disadvantages

It is based on information from all stock exchanges and other trading venues. Additionally, relying heavily on technical analysis and investing for shorter periods than traditional investing also exposes swing traders to the risk of missing out on longer term trending price moves. These kinds of people just flaunt fancy lifestyles to make you trade. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. After registration, you’ll get a ten digit Import Export Code IEC. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example. This approach involves buying and holding securities for a short period of time, usually from a few days to a few months. Options contracts are commission free, but crypto markups and markdowns are on the high side. As with all of these formations, the goal is to provide an entry point to go long or short with a definable risk. Get the latest industry news first. Understanding the psychological impact of tick size helps you develop better trading habits. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Swing trading often involves taking smaller position sizes than day trading does since the trader is aware of the inherent risks involved. Trading can be contrasted with investing in stocks, the approach to the stock market that aims to gradually build wealth by holding assets over a long period of time. Trade Nation is a trading name of Trade Nation Australia Pty Ltd, a financial services company registered in Australia under number ACN 158 065 635, is authorised and regulated by the Australian Securities and Investments Commission ASIC, with licence number AFSL 422661. Option types commonly traded over the counter include. Advertiser Disclosure: StockBrokers. With only $100, you would be lucky to find any full shares to purchase. These variations underscore the importance of understanding and adapting trading strategies to align with one’s psychological profile and life stage. Since American options offer more flexibility for the option buyer and more risk for the option seller, they usually cost more than their European counterparts. But fading can be a high risk strategy, as it goes against the current trend and may result in losses if the market does not quickly return to equilibrium levels. EToro is a multi asset investment platform. Create profiles for personalised advertising. In some instances, AI can substitute human labour as it rapidly analyses large datasets with minimal human intervention.

Milan Cutkovic

There are essentially three decisions you must make with options trading direction, price and time, which adds more complexity to the investing process than some people prefer. You now have Rs 1 crore cash in your portfolio account and a Rs 1 crore intraday trading limit. To help you understand the risks involved we have put together a series of Key Information Documents KIDs highlighting the risks and rewards related to each product. Traders observe the positive movement in the stock price. » Need to back up a bit. An Option is a contract that enables an investor to buy or sell an underlying instrument, such as a stock or even an index, at a set price, over a specified period, in exchange for a premium paid by the buyer to the seller. The following data may be collected but it is not linked to your identity. In a trading account, we compare not just profit and losses but also expenses and sales. This popular app provides users with a secure and user friendly way to store, manage, and exchange cryptocurrencies. Once a trading strategy is created and executed, the trader monitors the markets and manages the trading positions to ensure they align with the initial strategy. Like many financial markets, when you open a position on a cryptocurrency market, you’ll be presented with two prices. While the ideas behind the Black–Scholes model were ground breaking and eventually led to Scholes and Merton receiving the Swedish Central Bank’s associated Prize for Achievement in Economics a. ByBit is one of the top players in the crypto exchange industry. The 3 candle rule is a trading strategy that uses candlestick patterns to identify potential entry and exit points.